Imagine sending money urgently to someone, but the transfer fails just because you didn’t have the right IFSC code. Frustrating, right? That’s why understanding the Airtel Payment Bank IFSC code is not just helpful—it’s essential. Whether you’re using Airtel Bank for everyday banking or mobile payments, this guide will answer every question you might have.

Let’s break it down in a way that’s simple, informative, and most importantly—useful.

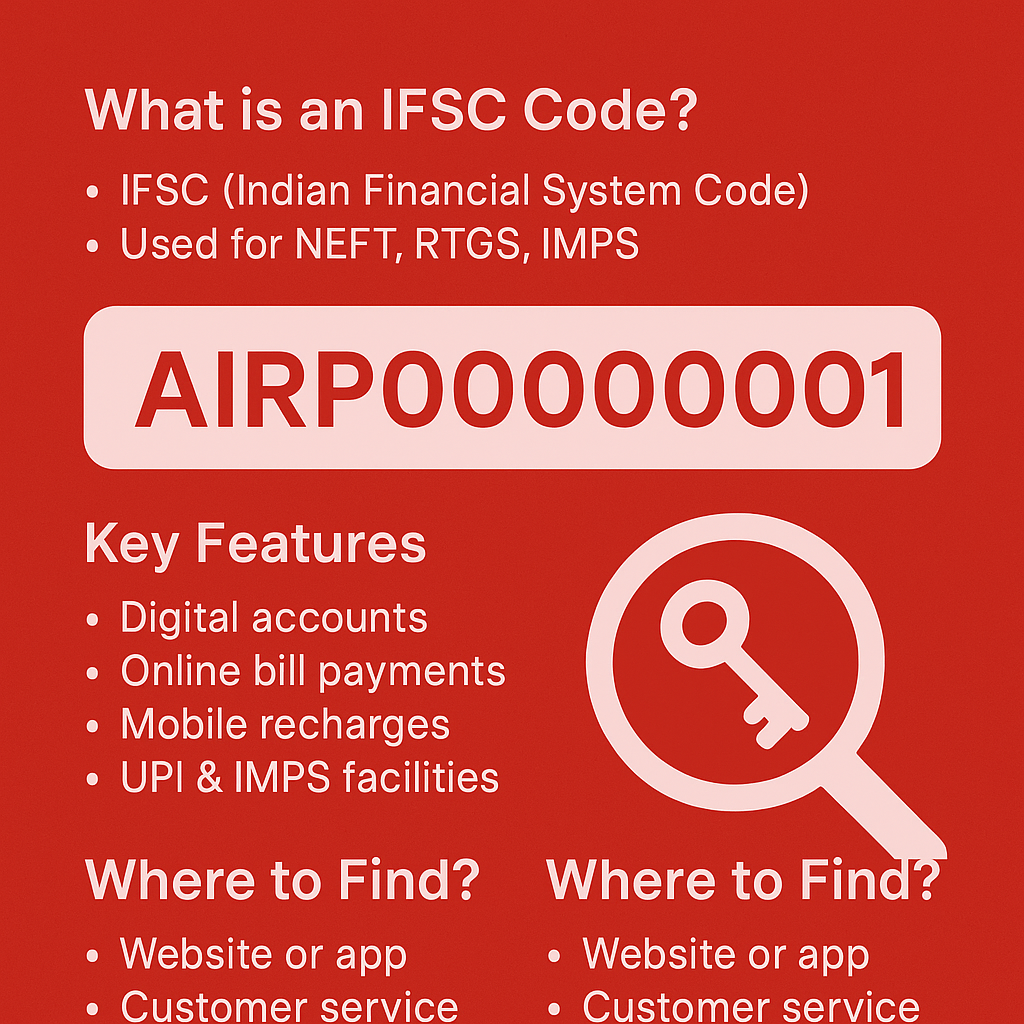

💡 What is an IFSC Code, and Why Does It Matter?

An IFSC (Indian Financial System Code) is an 11-digit alphanumeric code used by banks in India to identify specific branches during electronic fund transfers. It’s mandatory for services like:

- NEFT (National Electronic Funds Transfer)

- RTGS (Real Time Gross Settlement)

- IMPS (Immediate Payment Service)

Without it, your money might not reach the correct account—or worse, could bounce back.

Example:

For Airtel Payments Bank, the official IFSC code for the head office is:

AIRP0000001

This particular code helps systems pinpoint Airtel Payment Bank’s registered branch when performing online banking operations.

🏦 Airtel Payment Bank: A Quick Overview

Airtel Payments Bank, launched in 2017, is India’s first payment bank and is operated by Bharti Airtel in collaboration with Kotak Mahindra Bank. It provides:

- Basic savings and digital accounts

- Online bill payments

- Mobile recharges

- UPI & IMPS facilities

- Cash withdrawal/deposit at neighborhood banking points

Although it’s not a full-fledged commercial bank (meaning it cannot provide loans or credit cards), it plays a major role in rural and semi-urban financial inclusion.

Learn more directly from Airtel Payments Bank.

🧭 Where to Find the Airtel Payment Bank IFSC Code?

You can locate the IFSC code in several easy ways:

🔍 1. Airtel Payments Bank Website or App

Once logged into your account, you can find your IFSC code under the account details section.

📞 2. Customer Service

Call Airtel Payments Bank customer care at 400 (Airtel users) or 8800688006 (other users). They can guide you instantly.

🧾 3. Welcome Kit / Email Confirmation

When you open your Airtel Payments Bank account, the IFSC code is usually shared in the welcome email or kit.

🔗 4. Online IFSC Directory

Websites like RBI.org.in or BankBazaar provide official IFSC directories.

🧭 Airtel Payment Bank IFSC Code vs Other Banks

| Feature | Airtel Payments Bank | State Bank of India (SBI) | HDFC Bank | Paytm Payments Bank |

|---|---|---|---|---|

| IFSC Format | AIRP0000001 | SBIN000XXXX | HDFC000XXXX | PYTM0123456 |

| Branch-Based | No (single central IFSC code) | Yes | Yes | Yes |

| NEFT/IMPS/RTGS | Only NEFT, IMPS | All | All | NEFT, IMPS |

| Account Number Format | 10-digit mobile number | 11-16 digits | 14-digit | Mobile number-based |

| Minimum KYC Required | Yes | Yes | Yes | Yes |

➡️ As shown, Airtel Payment Bank has one universal IFSC code, making transactions simple but limiting flexibility in terms of branch-level services.

🔐 Is Using the Airtel IFSC Code Safe?

Absolutely. Airtel Payments Bank is governed by the Reserve Bank of India (RBI) and follows strict security protocols:

- End-to-end encryption

- Two-factor authentication

- Real-time alerts

- Secure UPI and IMPS systems

💡 Pro Tip: Always cross-check the IFSC code from the official source before transferring funds. Never rely on outdated third-party links.

📝 Use Cases: When You Need the Airtel Payment Bank IFSC Code

Here are some real-world scenarios where you’ll need the IFSC code:

- Receiving Money via NEFT/IMPS from other banks

- Linking your bank account to apps like Paytm, Google Pay, or PhonePe

- Filing Income Tax Returns (mentioning your bank details)

- KYC verification on mutual fund platforms

Even though you’re using a mobile number as your account number, the IFSC code completes the process by verifying the bank itself.

🧠 Common Mistakes to Avoid

Here are a few common blunders that can lead to payment failures:

❌ Using the wrong IFSC code (e.g., from another bank)

❌ Entering incorrect mobile number as account number

❌ Not completing full KYC, resulting in transaction limits

❌ Using third-party sources without verification

🔄 Always verify the IFSC code from Airtel’s official portal.

🌐 How to Use Airtel Payment Bank IFSC Code for NEFT or IMPS?

Let’s walk through a simple example.

💳 Step-by-Step: Sending Money via NEFT

- Login to your banking app (e.g., HDFC, SBI).

- Choose “Add Beneficiary.”

- Enter:

- Name: Your name

- Account Number: Airtel registered mobile number

- IFSC Code:

AIRP0000001

- Wait for beneficiary activation (usually 30 mins to 2 hours).

- Transfer the amount.

It’s that easy!

🔎 Bonus: What If You Don’t Enter IFSC Code?

If the IFSC code isn’t entered or is incorrect:

- Your transaction will either be delayed or canceled.

- Some platforms like UPI auto-detect bank names, but for NEFT/IMPS, it’s mandatory.

⚠️ So, IFSC = Bank’s Address in the Digital World.

📱 Personal Experience with Airtel Payments Bank

As a long-time Airtel user, I opened an Airtel Payments Bank account mainly for mobile recharges and bill payments. But soon I realized its broader utility.

Last year, while traveling in a remote area, I needed to transfer money to a friend but didn’t have access to my traditional bank. Airtel Bank saved the day.

Using the Airtel Payment Bank IFSC code, I received a transfer in seconds via IMPS. No branch, no hassle—just seamless digital banking.

It’s ideal for:

- Rural users

- Frequent travelers

- Small business owners

- Students using mobile-first banking

🧩 Airtel Bank vs Traditional Banking: Pros & Cons

| Pros | Cons |

|---|---|

| Easy digital onboarding | No loans or credit facilities |

| Universal IFSC code = less confusion | No branch-level customer support |

| Perfect for small & fast transactions | Transaction limits without full KYC |

| Great for prepaid services & utility bills | Limited investment options |

📢 Final Thoughts

The Airtel Payment Bank IFSC code may seem like a small detail, but it’s the backbone of smooth online banking with Airtel. Whether you’re sending or receiving money, knowing this code ensures speed, safety, and zero confusion.

With the growing popularity of digital-only banks, this knowledge becomes even more important for new-age users who rely on their phones more than physical branches.

✅ Take Action: What Should You Do Now?

- ✔️ Check if your Airtel Bank account is active and KYC-verified

- ✔️ Note down the IFSC code

AIRP0000001for safe use - ✔️ Share this post with someone who uses Airtel Bank

- ✔️ Bookmark Airtel’s official help center for future reference

- ✔️ Explore our related guides on UPI safety tips, Mobile banking limits, and Best payment banks in India

Have questions or personal experiences with Airtel Payments Bank? 💬 Drop them in the comments below—we’d love to hear from you! for more value info get back to Oklee.

Pingback: Central Bank Net Banking – Features & Safety Guide

Pingback: iBanking Bank Jateng – Cara Daftar, Login & Fitur Unggulan Online