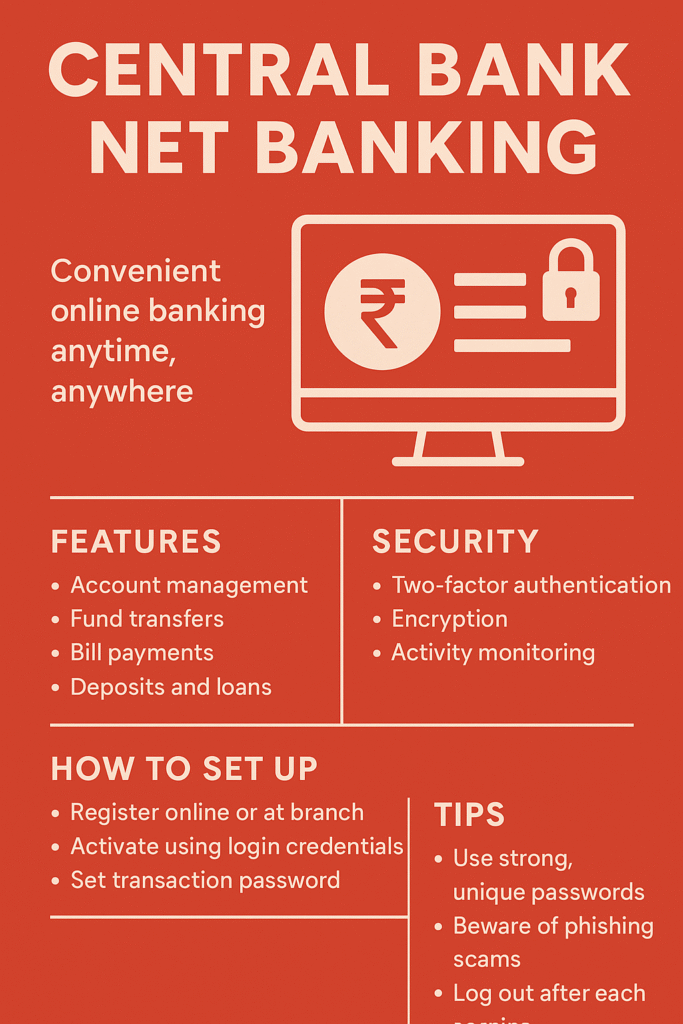

Imagine checking your account balance, paying bills, transferring funds, and managing investments—all without stepping into a branch. Welcome to the world of Central Bank Net Banking, a digital banking solution tailored for convenience, speed, and control.

If you’re a customer of the Central Bank of India or considering joining, this comprehensive guide will walk you through everything you need to know—from features to registration, real-life use cases, and even expert insights for secure usage.

💡 What is Central Bank Net Banking?

Central Bank Net Banking is an online banking service offered by the Central Bank of India, one of the country’s oldest and most trusted public sector banks. It allows you to manage your bank account anytime, anywhere using a computer or smartphone.

With it, you can:

- View account balance and statements

- Transfer money via NEFT, RTGS, and IMPS

- Pay utility bills and recharge mobile/DTH

- Open and manage fixed deposits or recurring deposits

- Request cheque books, stop payments, or block cards

- Track loans and apply for services online

Access Central Bank’s net banking portal here: https://www.centralbank.net.in

✨ Key Features That Make Central Bank Net Banking Stand Out

Unlike traditional banking, net banking gives you the flexibility to conduct secure transactions 24/7.

🔐 1. Robust Security Protocols

- Two-factor authentication (username + OTP)

- Transaction passwords for added protection

- Automatic session timeout

- Secure SSL encryption technology

🔄 2. Real-Time Fund Transfers

Transfer funds instantly to any bank account in India using IMPS or schedule payments using NEFT/RTGS. Transactions are seamless and trackable.

📲 3. Mobile-Friendly Experience

Though primarily web-based, net banking complements the Cent Mobile app, offering an integrated mobile banking experience.

📤 4. Digital Service Requests

Apply for loans, open deposits, request account statements, or block debit cards—all without visiting the branch.

🛠️ How to Register for Central Bank Net Banking

Getting started is easier than you think.

📝 Step-by-Step Registration:

- Visit https://www.centralbank.net.in

- Click on Online Services → Internet Banking → Retail User Login

- Select “New User Registration”

- Enter your account number, registered mobile number, and email ID

- Complete OTP-based verification

- Set your User ID and login password

- Log in for the first time and set your transaction password

✅ Pro Tip: Use a strong password (alphanumeric + symbols) and change it regularly.

🔄 Central Bank Net Banking vs Other Banks

| Feature | Central Bank of India | SBI Net Banking | HDFC NetBanking | Axis Bank Internet Banking |

|---|---|---|---|---|

| Account Overview | ✅ | ✅ | ✅ | ✅ |

| Bill Payments & Recharge | ✅ | ✅ | ✅ | ✅ |

| IMPS/NEFT/RTGS | ✅ | ✅ | ✅ | ✅ |

| Loan Application | ✅ | ✅ | ✅ | ✅ |

| Online KYC Update | ✅ | ✅ | ✅ | ✅ |

| Mobile Banking Integration | With Cent Mobile App | With YONO App | With HDFC App | With Axis Mobile |

Central Bank’s platform may not be the flashiest, but it ticks all functional boxes and remains reliable, especially for customers in Tier 2 and Tier 3 cities.

🧠 Real Use Cases from Daily Life

Here are some everyday situations where Central Bank Net Banking can save your time:

✅ Paying Utility Bills on a Deadline

Forget last-minute ATM visits—log in and clear electricity, gas, or phone bills instantly.

✅ Booking a Fixed Deposit at Midnight

Want to lock in an interest rate after market hours? Net banking lets you invest in FDs or RDs from your living room.

✅ Helping Family Remotely

Support your parents by transferring money or paying their broadband bill without traveling.

✅ Securing Statements for Tax Filing

Download detailed statements and interest certificates without requesting physical copies.

📈 Benefits of Using Central Bank Net Banking

Here’s why millions are going digital with Central Bank:

- 24/7 Convenience: No time restrictions or queues

- Wide Accessibility: Works from any internet-enabled device

- Paperless Banking: Eco-friendly and efficient

- Quick Service: Faster than manual processes

- Secure Platform: RBI-compliant digital safeguards

🛡️ Is Central Bank Net Banking Safe?

Yes—and here’s why:

- End-to-End Encryption: All data transmitted is encrypted with SSL certificates.

- Two-Layer Login: Includes OTP (One-Time Password) for added security.

- Auto Logout: Sessions end if inactive, reducing unauthorized access risks.

- No Shared Devices: Avoid logging in from cybercafés or shared systems.

- Alert Mechanism: Get real-time SMS/email alerts for every transaction.

Read more on RBI’s guidelines for secure digital banking here.

🧩 Common Mistakes to Avoid

Even the best users slip up—here are some to steer clear of:

❌ Saving login credentials on public or shared devices

❌ Ignoring phishing emails claiming to be from Central Bank

❌ Sharing OTPs or passwords over phone/email

❌ Clicking third-party login links (always go directly to the official site)

🧠 Tip: Bookmark the official login page to avoid fake websites.

💬 My Personal Experience with Central Bank Net Banking

When my father needed to renew his FD but couldn’t visit the branch due to health issues, I introduced him to Central Bank Net Banking. Though he was initially hesitant, the clear interface and step-by-step help from the local branch made it easy.

Today, he pays bills, transfers funds, and checks pension credits—all from his tablet. It’s a real testament to how digital banking can empower even senior citizens.

🔎 Central Bank Net Banking for Businesses

If you run a small or medium business, Central Bank offers Corporate Net Banking, also known as “Cent e-Banking Corporate”:

- Manage multiple accounts under one dashboard

- Approve multi-user fund transfers with different authorization levels

- Bulk upload salary payments

- Tax payments (GST, TDS, etc.) via online portal

➡️ Learn more about corporate banking services here.

📊 Quick Comparison Table: Retail vs Corporate Net Banking

| Feature | Retail User | Corporate User |

|---|---|---|

| Account Access | Single personal account | Multiple business accounts |

| Authorization Levels | Single user | Multi-user with roles |

| Fund Transfer Limit | Standard limits | Higher limits |

| Bulk Transactions | ❌ | ✅ |

| Tax Payments | Basic | Advanced (including GST) |

📣 Final Thoughts

Central Bank Net Banking is not just a tool—it’s a digital gateway that empowers users to take control of their finances, save time, and avoid unnecessary trips to the bank. Whether you’re a young professional, a business owner, or a retiree, the convenience and security it offers are worth embracing.

As India continues its shift to digital banking, Central Bank’s services provide a dependable, no-frills way to manage money anytime, anywhere.

✅ What’s Next?

- 🔐 Haven’t registered yet? Get started with Central Bank Net Banking today

- 🧾 Already a user? Explore our guide on How to Open FDs Using Net Banking

- 💬 Share your experience or ask questions in the comments below

- Want to find more about Airtel Payment Bank IFSC Code